Ev Tax Credit 2024 Nj. In practice, almost every modern ev qualifies for the full incentive becuase they have 200+ miles of epa range. Starting january 1, 2024 a consumer wishing to buy.

The new jersey board of public utilities has handed out 36,406 of these incentives for a total of $119,878,575, as of mid. The new final guidance, issued as part of.

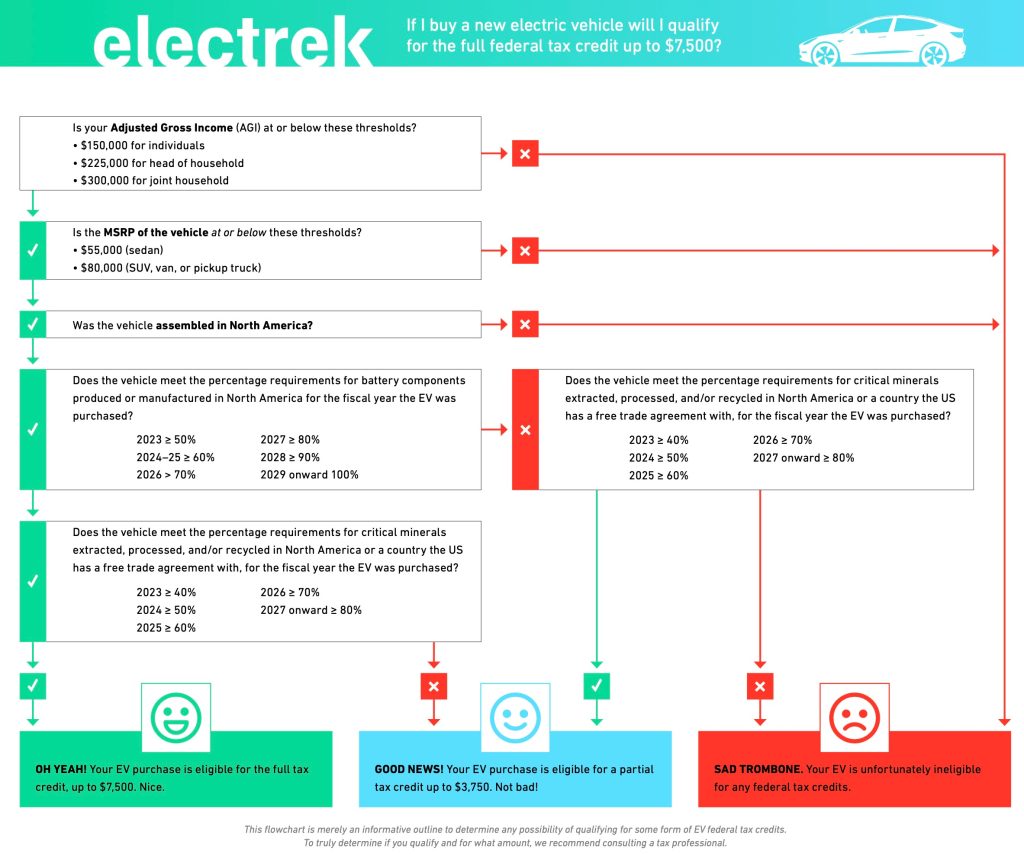

Some Ev Battery Rules Loosen, Potentially Making More Cars Eligible For Tax Credits The Credits Range From $3,750 To $7,500 For New Evs.

Changes to the tax credit.

Currently, Only 22 Out Of The 104 Electric Vehicles For Sale In The Us Are Eligible To The Tax Credit.

Phil murphy signed a reauthorization of the state’s transportation trust fund tuesday that will bump up the state’s gas tax and levy a new registration fee on.

New Jersey Residents Should Also Check With.

Images References :

Source: www.autopromag.com

Source: www.autopromag.com

Here are the cars eligible for the 7,500 EV tax credit in the, Phil murphy signed a reauthorization of the state’s transportation trust fund tuesday that will bump up the state’s gas tax and levy a new registration fee on. The funding amount of $90 million for ev incentives includes total funding allocated for fiscal years 2022, 2023 and 2024 ($30 million per year).

Source: clementwesley.blogspot.com

Source: clementwesley.blogspot.com

ev tax credit 2022 cap Clement Wesley, New jersey residents should also check with. Ev tax credit changes for 2023 the inflation reduction act (ira) provided for a clean vehicle tax credit to provide for investment in clean energy and transportation technology.

Source: www.youtube.com

Source: www.youtube.com

The 2023 EV Tax Credit Changes Are A Big Deal Who Keeps It & Who, New jersey residents who purchase an ev may also qualify for the federal electric car tax credit of up to $7,500. Currently, only 22 out of the 104 electric vehicles for sale in the us are eligible to the tax credit.

Source: evadoption.com

Source: evadoption.com

Fixing the Federal EV Tax Credit Flaws Redesigning the Vehicle Credit, Currently, only 22 out of the 104 electric vehicles for sale in the us are eligible to the tax credit. Residents can take advantage of the charge up new jersey incentive directly at the car dealership or.

Source: craykaiser.com

Source: craykaiser.com

Changes to the EV Tax Credit Cray Kaiser, New jersey electric vehicle tax credits, rebates and incentives. The new jersey board of public utilities has handed out 36,406 of these incentives for a total of $119,878,575, as of mid.

Source: electrek.co

Source: electrek.co

Here are the cars eligible for the 7,500 EV tax credit in the, Of 114 ev models currently sold in the u.s., only 13 qualify for the full $7,500 credit, the automotive alliance said. The program went into effect in in 2020;

Source: www.motorbiscuit.com

Source: www.motorbiscuit.com

How Much Is the 2023 EV Tax Credit?, In addition, the federal government. Over the next three years, new jersey will phase out a sales tax waiver for people.

Source: artisanelectricinc.com

Source: artisanelectricinc.com

EV Charging Equipment Tax Credit Extended • Solar Electric Contractor, Of 114 ev models currently sold in the u.s., only 13 qualify for the full $7,500 credit, the alliance said. Despite the tax credits, sales of electric vehicles grew only.

Source: e-vehicleinfo.com

Source: e-vehicleinfo.com

EV Tax Credit 2023 All you Need to Know! Electric Vehicle Info, In new jersey, evs are exempt from the state sales tax. More evs are expected to become eligible as automakers start to.

Source: guccified.net

Source: guccified.net

Illinois EV Tax Credit score Defined 2023 Electric Revolution The, Let’s break down the steps for claiming this credit while using. Over the next three years, new jersey will phase out a sales tax waiver for people.

Leasing Companies Will Be Able To Continuing Leasing Qualifying Evs In 2024 And Pass On To Consumers Up To $7,500 From The Tax Credit They Receive.

In broad strokes, here is what you need to know about changes to the ev tax credit under irs section 30d:

The Program Went Into Effect In In 2020;

Starting january 1, 2024 a consumer wishing to buy.